The role of the broker in the claims process

Have you suffered a loss and need to make an insurance claim? Whether personal or business-related, this is when the role of the broker in the claims process really proves their worth.

It’s the broker responsibility to ensure a smooth and successful outcome following an insured loss. Throughout the claims process, there are many aspects to be considered. Some are complex, whilst others may be more straightforward.

With an experienced broker, they will navigate this entire process for you. This benefit is one of the most significant advantages because they are there to serve you.

The broker is there to serve you, not the insurance company

How valuable is your time? Most can agree that their time is invaluable. Recently, Deloitte’s report found that brokers can save clients on average 11 hours per annum. The findings also showed that 41 per cent of SME clients would have felt that the claims process was ‘much harder’ without a broker’s support.

During this process, role of the broker is to help you save time, money, and energy. Although they have a relationship with the insurance provider, the brokers’ primary focus is on you, the client.

They will advocate for your needs, as well as waiting patiently on hold so they can get a faster outcome.

One interesting benefit that clients value is the empathy and emotional support they receive throughout this process. Usually, going through an insurance claim is the result of an adverse incident. When you have an experienced broker who understands your situation, this will lead to trust.

They’re someone you can trust

Trust between you and your broker is vital. After all, you are placing your faith and future into their hands. The broker seeks to understand your position, leading to better communication and trust.

When something goes wrong, the broker is the client’s point of contact. Having a personal relationship with clients means that you can feel comfortable calling them and knowing they’ll fix your problem.

Buying your insurance online or from a large, unknown entity means you don’t have that reliable point of contact. With a broker, you always know who to call, and it’s easy to speak to them and explain what happened.

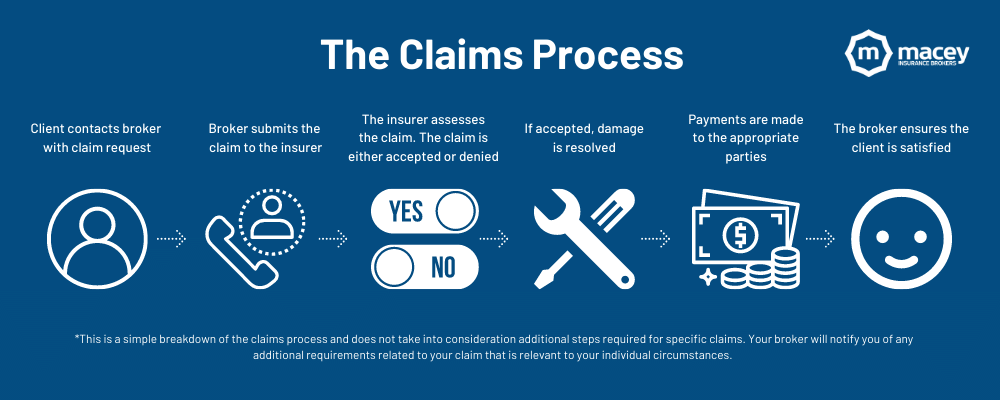

How does the claims process work?

The broker truly takes care of everything for the client; from assisting with forms to collating the necessary documents and information required to support your claim.

This takes away the complexity out of an otherwise overwhelming process, guiding the client in the right direction. The role of the broker is to read the fine print and explain to you in an easy to understand language.

Next, the broker lodges the claim with the insurer on the client’s behalf, handling all of the communication. Your broker is the expert and will ensure their clients get what they deserve at claim time.

The broker does have a strong relationship with the insurer, allowing them to effectively and thoroughly achieve claim solutions.

Because a broker works daily with insurance companies, they will naturally develop a working relationship with them. This rapport enables them to deal better with the insurance companies and come to the resolution you deserve.

Your broker ensures the claim is presented to the insurer clearly and legibly to assist in a speedy settlement. To do this, the broker makes sure that the insurer has everything they need to say YES to the claim and promptly.

When things aren’t as straightforward with a claim, the broker can negotiate with the insurer on behalf of the client to get the maximum benefits they are entitled to. Because the broker knows the client’s policy well, they can handle these disputes or issues expertly.

In most cases, the broker’s knowledge and expertise are far superior to that of the claims staff who work in claims departments. The broker’s relationships with the significant insurers also provide greater strength and leverage when managing tricky claims that may otherwise be declined.

We do things a little differently

The attentive client care of a Macey’s broker can directly assess risk and prevent losses from occurring, minimising the need for future claims.

After a major loss, the broker will make an on-site visit to help assess the loss and attend meetings with the client when Assessors and Loss Adjustors are required.

Before a loss even takes place, a broker assists with overall risk management from the start. The broker will assess and analyse the client’s property or business to prevent the losses from occurring in the first place. To achieve this, they will advise ways of minimising risks and aiding the client to select the best possible coverage for their needs.

The broker will ensure that clients have the correct cover when they first take out their insurance policies, working hard to be sure the client is protected. In the event when a loss does occur, they have adequate cover to protect them financially.

As you can see, the role of the broker is to provide multiple benefits to their clients. From taking care of the entire claims process to supporting them during a difficult time, many believe that insurance broker offers more value than what it costs. Start by researching local brokers to see which one have great reviews and experience.

Remember, only let a trusted and experienced broker handle your personal or business insurance needs. That’s why at Macey Insurance Brokers, your risks are our risks and we won’t rest until you’re protected.

Need an insurance broker?

At Macey Insurance Brokers, we train all our staff to treat each and every claim as if it were their own. Our team works hard to ensure the outcome is as they would expect if it were their own loss. We emphasise personal relationships in our organisation, and when you partner with us, we get to know you as a client and work to fully understand your risks. This personalised service means we can better help resolve claims for you, as well as better prepare and prevent losses from occurring. Contact our team at Macey’s today for more information and to discuss your specific situation.

This post was originally published on 19th February 2015.