Why should you be concerned about small business insurance?

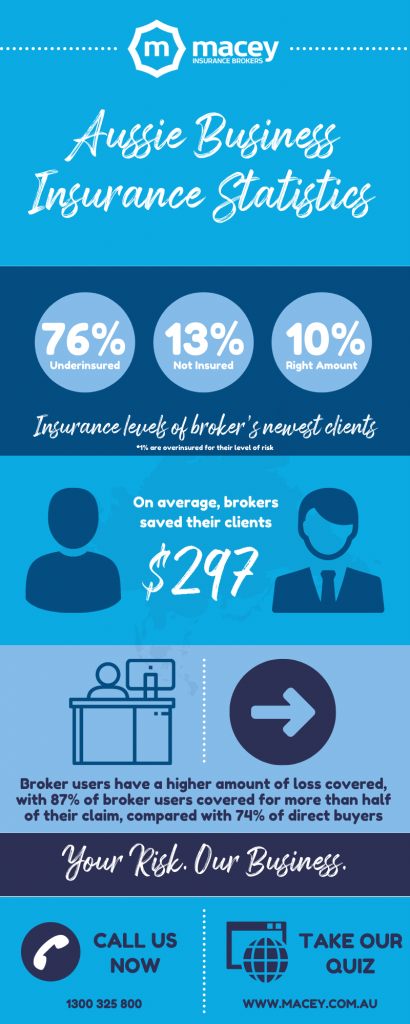

If you plan to start a business or are currently running one, you will need to consider small business insurance. But, why? If you want to ensure your business’s future success, you will need to view insurance as an essential defence strategy to help protect it. Alarmingly, recent research conducted by Deloitte “The Economic Value of Insurance Broking” (September 2020) showed that most businesses in Australia were exposed to risk and were either underinsured or not insured at all.

The research also found that many business owners who did have insurance without using a broker sometimes took up to twice as long to:

- Evaluate their risk profiles

- Apply for the product

- Compare and identify the ideal policies

- Make a claim, and

- Review and refine their annual policy

Business owners who had the assistance of an insurance broker through the claims process were also much less likely to feel that their claim is complicated. By having a broker involved in this process made the claims process more simplified. But surprisingly, it is the emotional support and empathy from brokers that provided the real value to business owners who needed someone they could rely on.

Ultimately, the findings showed that using a broker helped save businesses more than $297 per year for an average standard annual insurance lifecycle. They also received indirect benefits from avoiding costs associated with underinsured. This demonstrates that small businesses need to consider the importance of having a broker throughout the insurance process. By having a broker help them find the ideal policy combined with the right coverage, has proven to save time and money not only in the short-term but also contributes to the future long-term success of the business.

Disclaimer: The information provided in this article is general in advice only and does not reflect the opinions of NIBA and Deloitte.