In today’s dynamic business landscape, one truth remains constant: almost every Australian business requires insurance. However, navigating the maze of options can be daunting. From fledgling startups to established small businesses, understanding and mitigating risks is paramount. That’s why we created the small business checklist to ensure you secure the precise insurance coverage you need.

Define Your Business Type and Activities

Before diving into your insurance coverage, defining your business type and activities is essential. Think of this step as the foundation upon which your insurance strategy is built on. By thoroughly evaluating your business’s unique needs and risks and considering legal requirements, industry-specific obligations, and contractual responsibilities, you lay the foundation for comprehensive protection.

Here are some questions that you need to ask yourself about your business type and obligations:

▢ What are the primary risks associated with my business activities?

▢ Are there any legal or contractual obligations requiring specific insurance coverage?

▢ Are there industry-specific liabilities or exposures that I need to address?

Protect Your Assets

Protecting your assets involves assessing the need for insurance to safeguard essential physical assets like property, stock, equipment, and tools vital for smooth business operations. By considering property insurance tailored to your specific business needs and location, you ensure comprehensive coverage against events like fire, storm, or malicious damage.

When protecting your assets, consider the following:

▢ Do I have an inventory of essential physical assets?

▢ What are the potential risks to my assets, such as damage or loss?

▢ Have I explored property insurance options tailored to my business needs and location?

Safeguard Your Revenue

Protecting your revenue is vital for maintaining your business’s financial health. It involves implementing measures to mitigate income loss and ensure continuity in operations. This can be achieved through business interruption insurance, which covers ongoing expenses and helps to resume operations after an insured event disrupts business activities.

Additionally, ensuring coverage extends to essential costs such as rent, mortgage repayments, utilities, and additional expenses incurred during disruptions is crucial for minimising the impact on revenue streams.

▢ Have I assessed potential income loss scenarios for my business?

▢ Do I have business interruption insurance to cover ongoing expenses?

▢ Does my coverage extend to rent, mortgage repayments, utilities, and additional costs incurred during disruptions?

Secure Public Liability Insurance

Securing public liability insurance is crucial for safeguarding your business against potential legal action and damages arising from third-party claims. This coverage protects you in situations where someone outside your business suffers injury, property damage, or economic loss due to your negligence.

By considering industry-specific requirements and potential liabilities, you ensure compliance while safeguarding your business’s financial and reputational interests.

▢ What are the potential risks of third-party claims against my business?

▢ Have I assessed my business’s exposure to liability risks, considering its nature and operations?

▢ Have I explored industry-specific requirements for public liability insurance to ensure comprehensive coverage?

Invest in Professional Indemnity Insurance

Investing in professional indemnity insurance is essential if your business provides professional services or advice. This coverage helps mitigate the risk of negligence claims by covering potential liabilities stemming from errors, omissions, or breaches of professional duty.

By securing professional indemnity insurance, you ensure financial protection and peace of mind, safeguarding your business’s reputation and assets.

▢ What are the potential risks of negligence claims in my line of work?

▢ Have I assessed my business’s exposure to professional liability risks?

▢ Does my professional indemnity insurance cover potential errors, omissions, or breaches of professional duty?

Find an Insurance Broker for Professional Expertise

Finding a broker with professional expertise is crucial for navigating the complexities of insurance coverage. By engaging a professional insurance broker, you gain access to specialised knowledge to address your business’s unique requirements. A broker can help negotiate policy contracts and provide strategic risk management tailored to your needs. With personalised advice and access to specialised coverage options for niche sectors, you ensure comprehensive protection and peace of mind.

▢ Have I assessed my business’s insurance needs and the complexity of coverage required?

▢ Am I aware of the specialised risks associated with my industry or niche sector?

▢ Have I explored the benefits of working with a licensed broker for personalised advice and access to specialised coverage options?

Conclusion

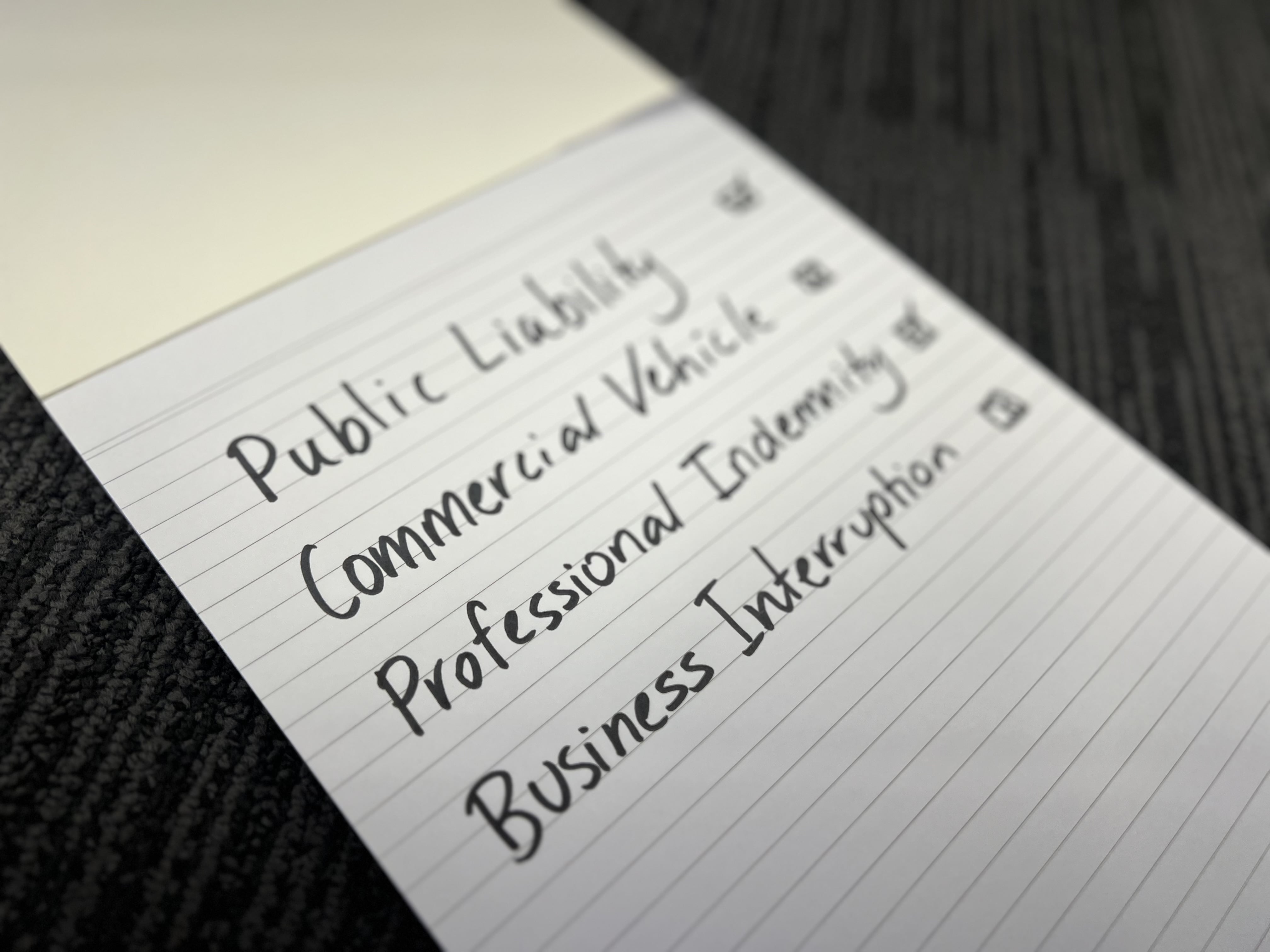

In the dynamic landscape of business, robust insurance coverage is essential for safeguarding your venture. Our essential small business insurance checklist serves as your roadmap, tailored to guide you through the intricacies of coverage. From defining your business type to securing public liability and professional indemnity insurance, each step mitigates risks and fortifies your business’s foundation for success.

By assessing vulnerabilities and exploring insurance options, you protect your assets and ensure long-term stability. Whether a novice entrepreneur or a seasoned business owner, comprehensive coverage is paramount. With guidance and the right solutions, you can navigate insurance complexities and steer your business towards a secure future.

Disclaimer:

The information provided in this blog post is intended for general informational purposes only. It is not intended to be, nor should it be construed as, professional advice tailored to your specific business or personal circumstances.

Every business is unique, and the insurance needs of each business can vary based on factors such as industry, location, size, and specific activities. Therefore, we strongly recommend that you seek professional advice from a qualified insurance advisor or broker to assess your individual insurance needs and obtain appropriate coverage for your business.

While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information contained in this blog post.